Statistical Methods in Finance 2025

Financial Modeling, Risk, and Resilience in a Changing World

December 16 to 20, 2025

Skip menuAbstract

|

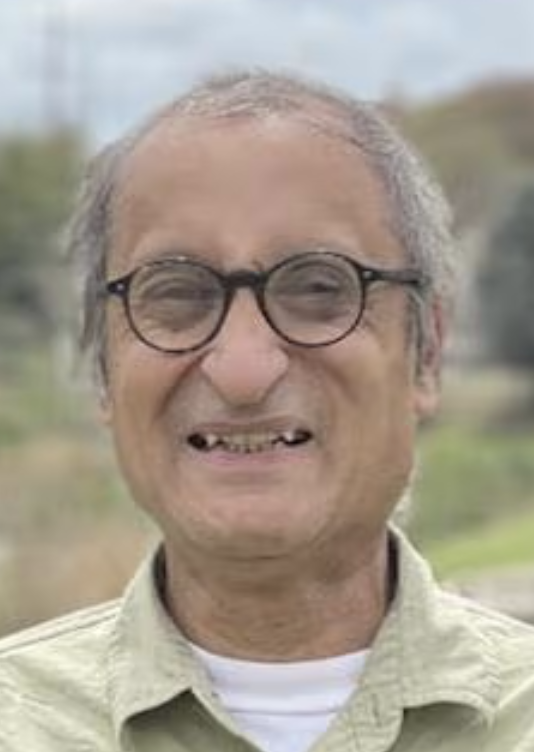

Portfolio Optimization beyond Markowitz Mean Variance Portfolio OptimizationBy:Choudur Lakshminarayan Stevens Instituteof Technology, USA |

|

Mean variance portfolio optimization by Harry Markowitz ushered an era of quantitative decision making in asset allocation. In MVPO formulation the risk of a portfolio (variance) is optimized subject to linear constraints on assets and the target returns. However, due to potential instability in the covariance matrix (correlations, number of assets number of observations) as well as underlying distributions of the returns may be non-normal, alternative approaches have been proposed. We outline an information theoretic variance stabilization and optimization approach and trace the arc of evolution of portfolio optimization in finance. |